From the 1st April 2019, all VAT registered businesses must submit their VAT returns online using HMRC approved software. This section will guide a Florist, or their Accountant, through processing a VAT return and submitting it online to HMRC using Floral Frog.

- The first step is to register for Making Tax Digital via HMRC’s website. The link is:

https://www.tax.service.gov.uk/vat-through-software/sign-up/have-software - You may have to wait 48 hours before being able to submit VAT returns online.

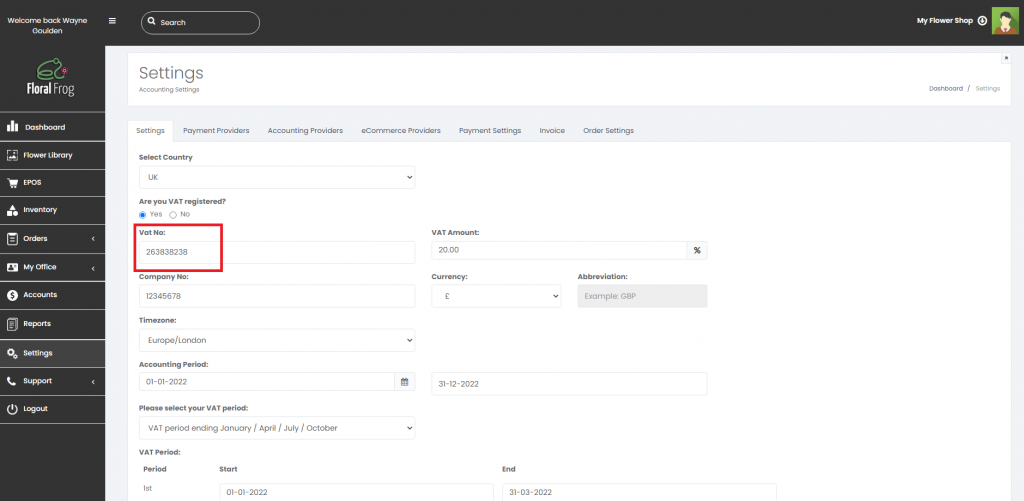

- The next step is to ensure your VAT number is correct within Floral Frog. To confirm this, go to “”Settings” and your VAT number will be displayed as shown below.

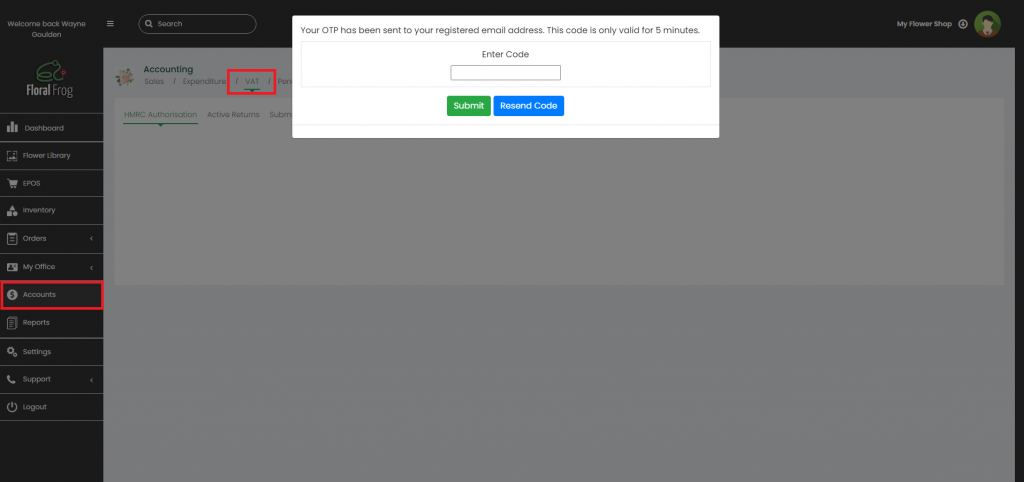

- The next step is to connect to HMRC. To do this, go to “ACCOUNTS” and then select the “VAT” tab. Before you can connect to HMRC you will be challenged for a one-time PIN (OTP). This is a six digit random number that is generated by the system and sent to your registered email address. If you are unsure of your registered email address then check your profile settings in the top right of the screen. You have 5 minutes to enter the OTP else you will have to click on “Resend Code” – see screenshot below.

- Click on the green “Renew Authorisation” button.

- A pop-up window will appear from HMRC. Read the Authority to interact with HMRC statement and then click “Continue“.

- You will then be requested to enter your HMRC User ID and Password. This is also known as your Government Gateway ID. Submit your details and click “Sign In“.

- Once signed in, click “Grant Authority” to interact with HMRC, as shown below.

- You can then click “Close this Window” to complete the process.

- After refreshing your web browser (click F5), you can see your HMRC authorisation status, as shown below. This will last for a 6 month period. Please note that all the above steps are performed once every 6 months.

- The next step is to process your VAT return ready for submission. Please ensure you have entered all of your Sales and Expenditure into the system for the VAT period you are generating a return for.

- The create a new VAT return, go to “ACCOUNTS” > “Accounting” and then select the “VAT” tab on the right, as shown below.

- Click the green “New Return” button.

When the “New Return” button is clicked, the VAT form will appear. There are five steps required on the form as follows:

- Select VAT period from drop-down menu

- Click “Calculate” button.

- Check your figures and then tick the declaration box at the bottom

- Click the “Save” button

- Click the “Close” button

- Prior to submitting the VAT return, you need to select the return from the list as shown below and click the “Lock Return” button. The “Locked” column next to “HMRC Status” should say “Yes“. This means that once locked you can no longer update the form, or re-calculate for that period.

- To submit your VAT return, click on the relevant VAT return in the table and then click “Submit Return”. You will then be asked to confirm submission.

- Once submitted you will see a pop-up saying “VAT returned successfully for the period 00-00-00 to 00-00-00” . The zero’s denote the date range. Please see example below.

- Once the VAT return has been submitted to HMRC, it will move from the “Active Returns” tab to the “Submitted Returns” tab.

- You can then select the submitted return and click on the hyperlink in the end column. This will produce a pop-up windows that will display the HMRC return status information which validates successful submission.